"Banks offer many different channels to access their banking and other services:

(1) Automated Teller Machines.

(2) A branch is a retail location.

(3) Call center.

(4) Mail: most banks accept cheque deposits via mail and use mail to communicate to their customers, e.g. by sending out statements.

(5) Mobile banking is a method of using one's mobile phone to conduct banking transactions.

(6) Online banking is a term used for performing multiple transactions, payments etc. over the Internet.

(7) Relationship Managers, mostly for private banking or business banking, often visiting customers at their homes or businesses.

(8) Telephone banking is a service which allows its customers to conduct transactions over the telephone with automated attendant or when requested with telephone operator.

(9) Video banking is a term used for performing banking transactions or professional banking consultations via a remote video and audio connection. Video banking can be performed via purpose built banking transaction machines (similar to an Automated teller machine), or via a video conference enabled bank branch clarification.

(10) DSA is a Direct Selling Agent, who works for the bank based on a contract. Its main job is to increase the customer base for the bank." [Bank. Wikipedia]

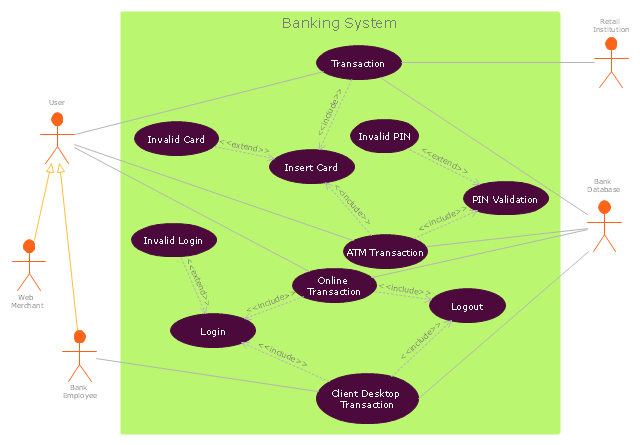

The UML use case diagram example "Banking system" was created using the ConceptDraw PRO diagramming and vector drawing software extended with the Rapid UML solution from the Software Development area of ConceptDraw Solution Park.

(1) Automated Teller Machines.

(2) A branch is a retail location.

(3) Call center.

(4) Mail: most banks accept cheque deposits via mail and use mail to communicate to their customers, e.g. by sending out statements.

(5) Mobile banking is a method of using one's mobile phone to conduct banking transactions.

(6) Online banking is a term used for performing multiple transactions, payments etc. over the Internet.

(7) Relationship Managers, mostly for private banking or business banking, often visiting customers at their homes or businesses.

(8) Telephone banking is a service which allows its customers to conduct transactions over the telephone with automated attendant or when requested with telephone operator.

(9) Video banking is a term used for performing banking transactions or professional banking consultations via a remote video and audio connection. Video banking can be performed via purpose built banking transaction machines (similar to an Automated teller machine), or via a video conference enabled bank branch clarification.

(10) DSA is a Direct Selling Agent, who works for the bank based on a contract. Its main job is to increase the customer base for the bank." [Bank. Wikipedia]

The UML use case diagram example "Banking system" was created using the ConceptDraw PRO diagramming and vector drawing software extended with the Rapid UML solution from the Software Development area of ConceptDraw Solution Park.

"An automated teller machine or automatic teller machine" (ATM) (American, Australian, Singaporean, Indian, and Hiberno-English), also known as an automated banking machine (ABM) (Canadian English), cash machine, cashpoint, cashline or hole in the wall (British, South African, and Sri Lankan English), is an electronic telecommunications device that enables the clients of a financial institution to perform financial transactions without the need for a cashier, human clerk or bank teller.

On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smart card with a chip that contains a unique card number and some security information such as an expiration date or CVVC (CVV). Authentication is provided by the customer entering a personal identification number (PIN). The newest ATM at Royal Bank of Scotland allows customers to withdraw cash up to £100 without a card by inputting a six-digit code requested through their smartphones.

Using an ATM, customers can access their bank accounts in order to make cash withdrawals, get debit card cash advances, and check their account balances as well as purchase pre-paid mobile phone credit. If the currency being withdrawn from the ATM is different from that which the bank account is denominated in (e.g.: Withdrawing Japanese yen from a bank account containing US dollars), the money will be converted at an official wholesale exchange rate. Thus, ATMs often provide one of the best possible official exchange rates for foreign travellers, and are also widely used for this purpose." [Automated teller machine. Wikipedia]

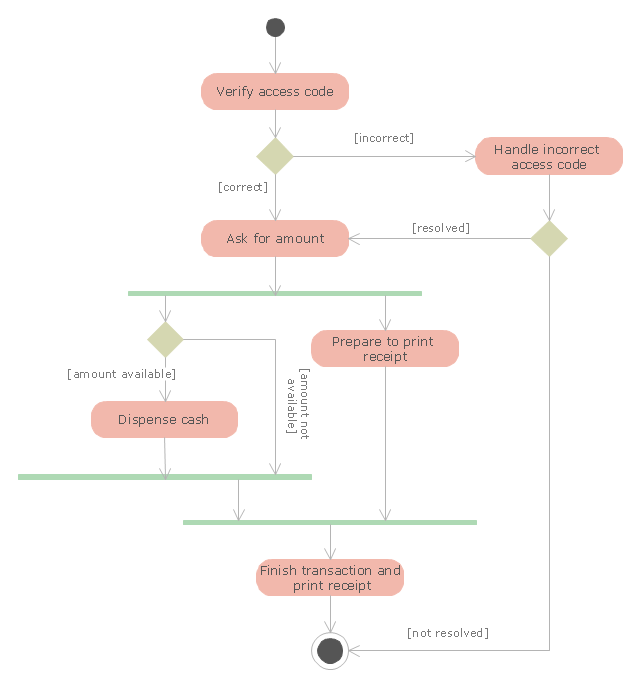

The UML activity diagram example "Cash withdrawal from ATM" was created using the ConceptDraw PRO diagramming and vector drawing software extended with the Rapid UML solution from the Software Development area of ConceptDraw Solution Park.

On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smart card with a chip that contains a unique card number and some security information such as an expiration date or CVVC (CVV). Authentication is provided by the customer entering a personal identification number (PIN). The newest ATM at Royal Bank of Scotland allows customers to withdraw cash up to £100 without a card by inputting a six-digit code requested through their smartphones.

Using an ATM, customers can access their bank accounts in order to make cash withdrawals, get debit card cash advances, and check their account balances as well as purchase pre-paid mobile phone credit. If the currency being withdrawn from the ATM is different from that which the bank account is denominated in (e.g.: Withdrawing Japanese yen from a bank account containing US dollars), the money will be converted at an official wholesale exchange rate. Thus, ATMs often provide one of the best possible official exchange rates for foreign travellers, and are also widely used for this purpose." [Automated teller machine. Wikipedia]

The UML activity diagram example "Cash withdrawal from ATM" was created using the ConceptDraw PRO diagramming and vector drawing software extended with the Rapid UML solution from the Software Development area of ConceptDraw Solution Park.

- Package Diagram With Example In Banking System Model

- UML Diagram | Design elements - Bank UML package diagram ...

- UML Activity Diagram | UML Use Case Diagram Example Social ...

- UML use case diagram - Banking system

- UML for Bank

- UML activity diagram - Cash withdrawal from ATM | UML ...

- Class UML Diagram for Bank Account System

- UML Deployment Diagram Example - ATM System UML diagrams ...

- Analysia Of Uml Banking System

- Use Case Diagram For Banking System In Uml

- UML Diagram | Credit Card Order Process Flowchart. Flowchart ...

- UML Diagram | UML use case diagram - Banking system | Design ...

- UML use case diagram - Banking system | UML Use Case Diagram ...

- Draw A System And Program Flowchart Of How An Atm Machine ...

- UML Deployment Diagram Example - ATM System UML diagrams ...

- UML Diagram | Databases Access Objects Model with ConceptDraw ...

- UML Diagram | DFD Library System | Process Flowchart | System ...

- UML use case diagram - Banking system | UML Diagram | PM Easy ...

- Class UML Diagram for Bank Account System | ATM UML Diagrams ...