"Porter five forces analysis is a framework for industry analysis and business strategy development. It draws upon industrial organization (IO) economics to derive five forces that determine the competitive intensity and therefore attractiveness of a market. Attractiveness in this context refers to the overall industry profitability. An "unattractive" industry is one in which the combination of these five forces acts to drive down overall profitability. A very unattractive industry would be one approaching "pure competition", in which available profits for all firms are driven to normal profit.

Three of Porter's five forces refer to competition from external sources. The remainder are internal threats.

Porter referred to these forces as the micro environment, to contrast it with the more general term macro environment. They consist of those forces close to a company that affect its ability to serve its customers and make a profit. A change in any of the forces normally requires a business unit to re-assess the marketplace given the overall change in industry information. The overall industry attractiveness does not imply that every firm in the industry will return the same profitability. Firms are able to apply their core competencies, business model or network to achieve a profit above the industry average. A clear example of this is the airline industry. As an industry, profitability is low and yet individual companies, by applying unique business models, have been able to make a return in excess of the industry average.

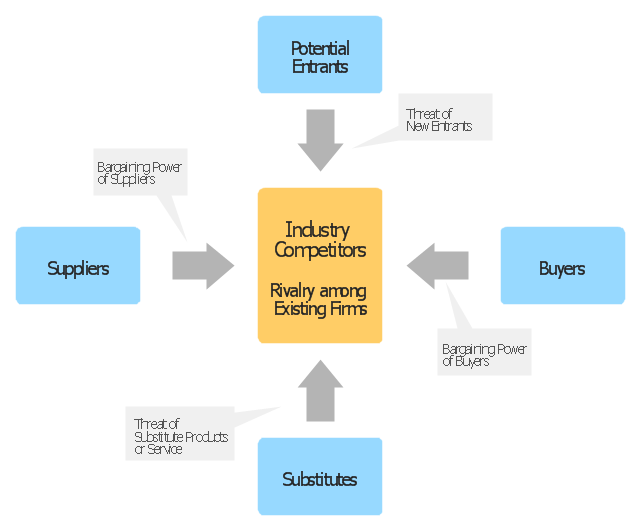

Porter's five forces include - three forces from 'horizontal' competition: the threat of substitute products or services, the threat of established rivals, and the threat of new entrants; and two forces from 'vertical' competition: the bargaining power of suppliers and the bargaining power of customers.

This five forces analysis, is just one part of the complete Porter strategic models. The other elements are the value chain and the generic strategies." [Porter five forces analysis. Wikipedia]

The block diagram example "Porter's five forces model" was created using the ConceptDraw PRO diagramming and vector drawing software extended with the Block Diagrams solution from the area "What is a Diagram" of ConceptDraw Solution Park.

Three of Porter's five forces refer to competition from external sources. The remainder are internal threats.

Porter referred to these forces as the micro environment, to contrast it with the more general term macro environment. They consist of those forces close to a company that affect its ability to serve its customers and make a profit. A change in any of the forces normally requires a business unit to re-assess the marketplace given the overall change in industry information. The overall industry attractiveness does not imply that every firm in the industry will return the same profitability. Firms are able to apply their core competencies, business model or network to achieve a profit above the industry average. A clear example of this is the airline industry. As an industry, profitability is low and yet individual companies, by applying unique business models, have been able to make a return in excess of the industry average.

Porter's five forces include - three forces from 'horizontal' competition: the threat of substitute products or services, the threat of established rivals, and the threat of new entrants; and two forces from 'vertical' competition: the bargaining power of suppliers and the bargaining power of customers.

This five forces analysis, is just one part of the complete Porter strategic models. The other elements are the value chain and the generic strategies." [Porter five forces analysis. Wikipedia]

The block diagram example "Porter's five forces model" was created using the ConceptDraw PRO diagramming and vector drawing software extended with the Block Diagrams solution from the area "What is a Diagram" of ConceptDraw Solution Park.

Matrices

Matrices

This solution extends ConceptDraw PRO software with samples, templates and library of design elements for drawing the business matrix diagrams.

- Porter's generic strategies matrix diagram | SWOT Analysis Solution ...

- Porter's value chain matrix diagram | Marketing | Porter's generic ...

- Porter's generic strategies matrix diagram | Block diagram - Porter's ...

- Porter's generic strategies matrix diagram | Matrices | Porter's Value ...

- Porter's generic strategies matrix diagram | Block diagram - Porter's ...

- Porter's value chain matrix diagram | Porter's generic strategies ...

- Porter's generic strategies matrix diagram | Porter's Value Chain ...

- Authority Matrix Diagram Software | Porter's value chain matrix ...

- Porter's generic strategies matrix diagram | Competitive strategy ...

- Porter's generic strategies matrix diagram | Porter's Value Chain ...

- Competitive strategy matrix template | Porters Generic Strategy ...

- Competitive strategy matrix | Porter's generic strategies matrix ...

- Porter's generic strategies matrix diagram | Competitive strategy ...

- SWOT and TOWS Matrix Diagrams | Matrices | Porter's value chain ...

- Marketing | Porter's value chain matrix diagram | Porter's generic ...

- Competitive strategy matrix - Template | Competitive strategy matrix ...

- Block diagram - Porter's five forces model | Porter S Generic Strategies

- Porter's generic strategies matrix diagram | Competitive strategy ...

- SWOT Analysis Solution - Strategy Tools | Competitive strategy ...

- Strategic planning cycle - Arrow loop diagram | Strategic planning ...